3 tips to prevent public liability claims

Did you know that your small business can change the way other companies operate?

9th March 2017

4 trends that impact South African cyber security in 2017

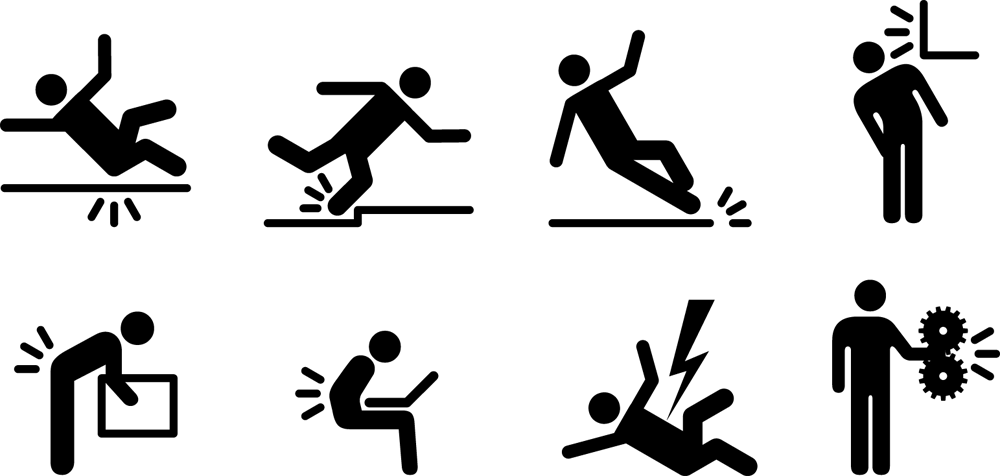

23rd March 2017Drowning and falling, crashing and tripping. These are just a few accidents that may take place on a private or public property, and whether the property is used for a small business or building site, you or your company will be held responsible for public liability.

Public liability is a huge risk factor in Durban and the rest of South Africa, and many insurance companies find it too risky to cover public liability. You wouldn’t believe the cases Jerome Schofield cc Insurance Brokers (JSib) are regularly involved in. Hair dressers accidently cutting an ear, hospitals delivering a birth wrong, unsterilized equipment, a horse kick, the list goes on. There are far too many accidents that take place in the public sphere not to be extra careful and/or get public liability insurance.

Here are 3 tips to ensure public safety if you don’t have public liability insurance:

Tripping and slipping.

One can take minor precautions too, in order to prevent the public from injuries. For example, keeping paths free from flooding and debris which may cause customers and employees to fall. Also, it’s important to keep steps walkways and roads in good condition. This means one cannot be shy to hire a handyman if need be, as he/she can save you unnecessary hassles.

Put up relevant signage.

This is necessary as it helps the public become aware of a certain issue that may put them or their goods in danger. Issues such as unlevelled ground, steps, potholes, falling objects and heated areas, or, on those rainy Durban days, wet floors.

Know your risks.

If you are your own boss, you should be aware of where your customers and employees may be in danger, and if you aren’t covered for public liability we highly recommend getting a specialised quote, as different workplaces have their own responsibilities to meet. For example, swimming teachers could be liable for deaths caused by drowning, slipping or other water injuries, and if proven negligent, restaurant owners may be liable for food poisoning, fires and anything else that may affect the public. According to Unisa (2014), “every person owes a duty of care to other members of the public or society,” and “if they are negligent and do not take care… then they can be held responsible at law to pay compensation to the injured person, or his estate.”

Another good example are schools. All schools should be covered with public liability insurance as there is so much of which to be mindful. The same goes for businesses and shops. These places operate hugely in society, and “legal costs are extremely expensive” (Unisa, 2014) so in an incident; like a fire that damages neighbouring property, one can rely on their public liability policy, as it “is designed to cover these costs as well as any damages awarded” (Unisa, 2014).

Are you being held publicly liable for an accident or do you need a quote? Give us a call and we can advise you or recommend a good and suitable insurance company for you.

Referance list:

Unisa, 2014. Primciples of Short Term Insurance PAIP02H. IISA Programme in Advance Insurance Practice (76481), pg. 49.

Unisa, 2014. Primciples of Short Term Insurance PAIP02H. IISA Programme in Advance Insurance Practice (76481), pg. 50.

Unisa, 2014. Primciples of Short Term Insurance PAIP02H. IISA Programme in Advance Insurance Practice (76481), pg. 50.